An Interval Fund Delivering Access to Private Credit with a Daily NAV

Evergreen Private Credit

iDirect Private Credit Fund (“iDPC”) is a daily interval credit fund offering low-cost, pure play exposure to middle market corporate lending alongside three leading private credit managers.

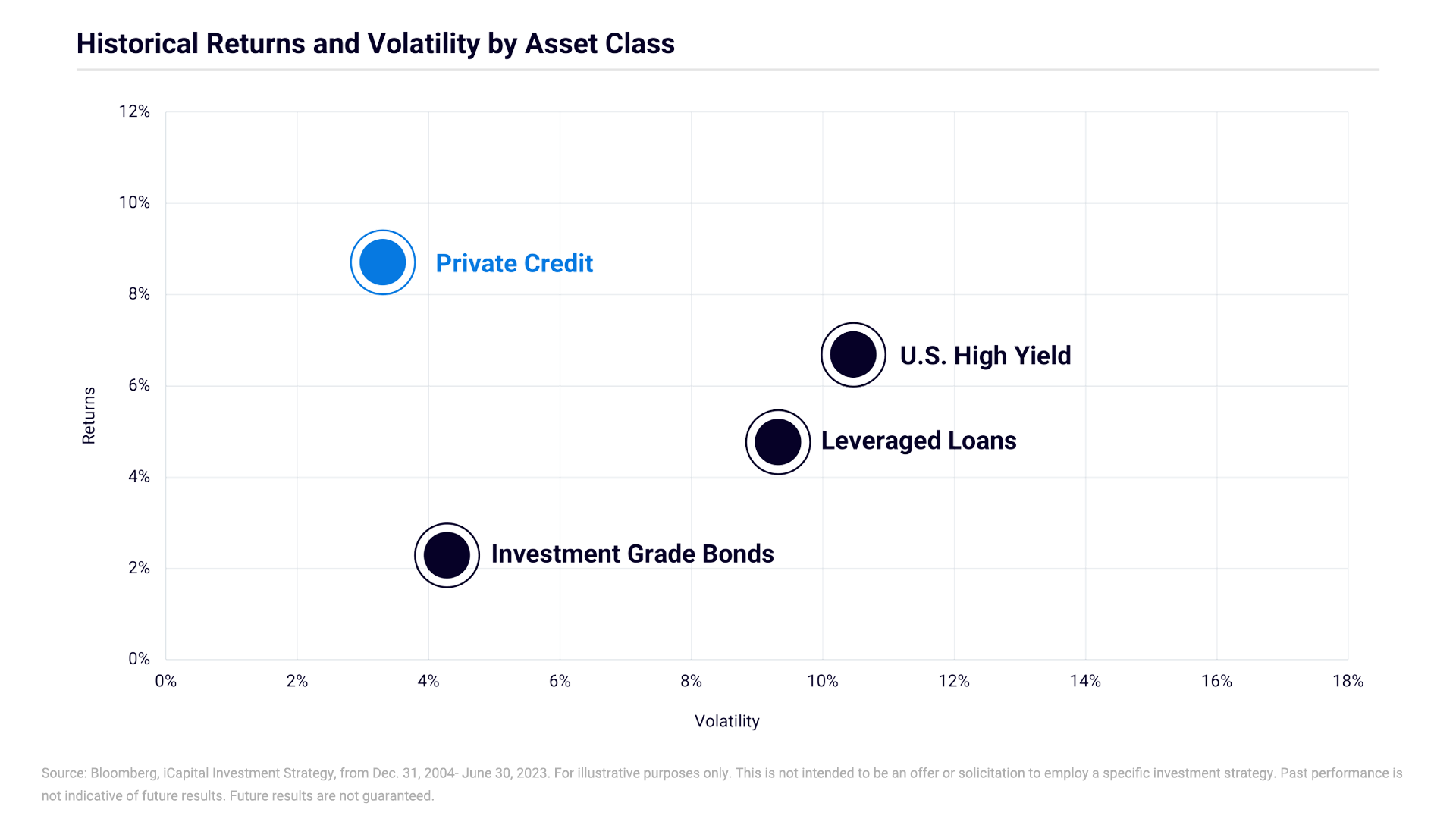

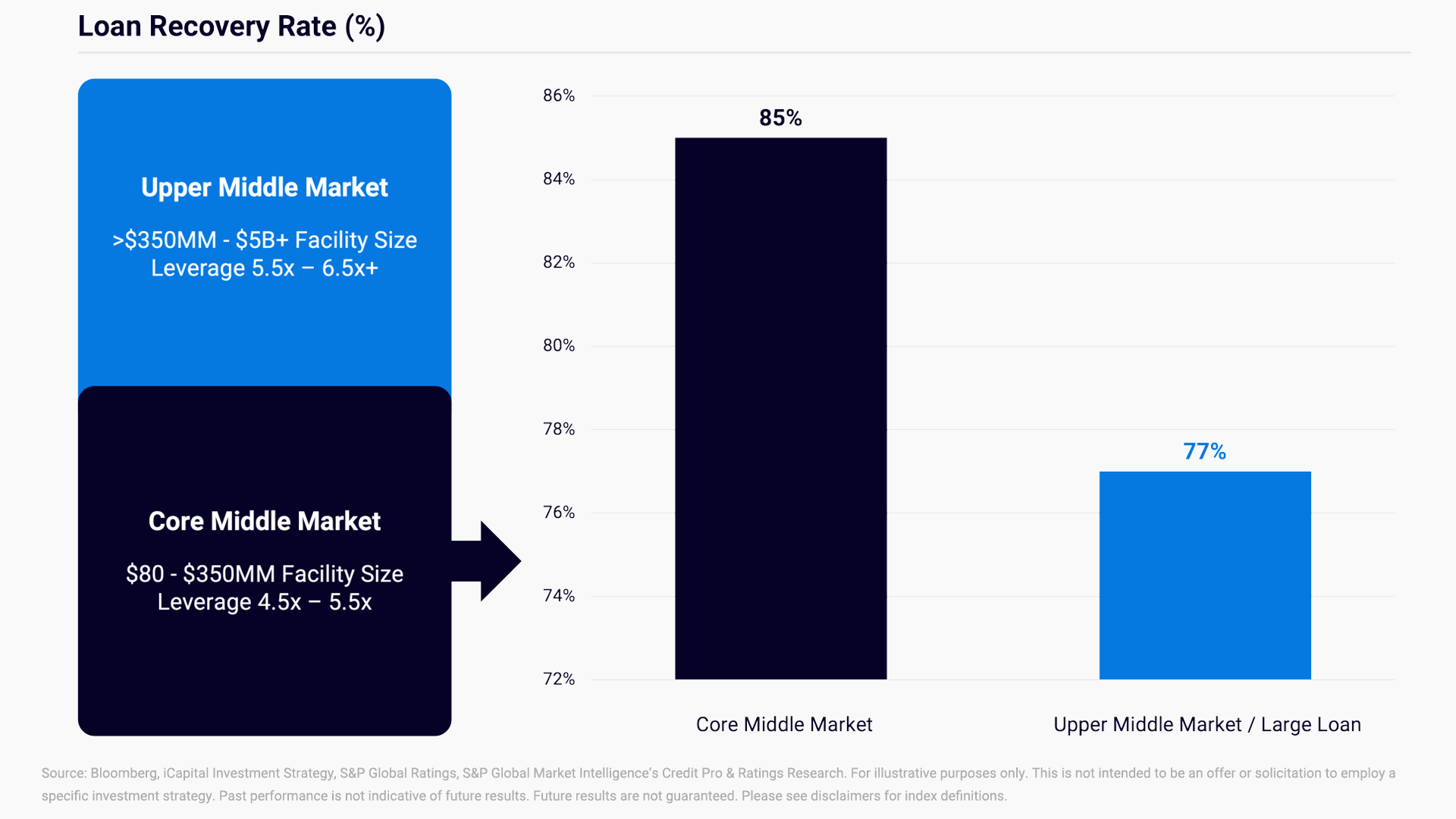

Pure Play Private Credit

- 95%+ senior secured lending portfolio

- 100% sponsor-backed companies

- 100% middle market focus

- 100% floating rate loans

Easy-to-Use Structure

- Available through a ticker (DPCIX | DPCDX | DPCAX)

- Evergreen fund without capital calls

- Quarterly liquidity, daily NAV

- 1099 reporting

Low Cost

- Efficient cost structure

- No incentive fee

- Low minimum investment

Gain Access To Three Top-Performing Private Credit Managers

Best-in-class track records

Strong historical performance and consistently low

loss ratios

Decades of disciplined buying

Over 50 years of disciplined buying throughout all cycles

Significant Scale

250+ investment professionals on the ground globally

Learn More and Watch the Latest iDPC Quarterly Update Here

iDirect Private Markets Fund

Q3 2024 Update

- Key updates on iDPE performance and positioning

- The impact of interest rates and the election

- KKR’s perspectives on how these factors may influence the private markets

Learn More

Note: While the portfolio composition that has been developed by iCapital Registered Fund Adviser LLC (the Fund’s investment adviser) reflects their assessment of the relative attractiveness of sub-sectors within the context of an appropriately diversified portfolio, given the percentage of assets that will be invested in Investment Interests sponsored or managed by Kohlberg Kravis Roberts & Co. L.P. or an affiliate (collectively, “KKR”), Vista Equity Partners Management, LLC or an affiliate (collectively, “Vista”), or Warburg Pincus LLC or an affiliate (collectively, “Warburg Pincus”) and with KKR and Vista, (the “Core Independent Managers”), the Fund will be exposed to risks related to the core independent managers. As of Feb. 12, 2021, iCapital Registered Fund Adviser LLC is the investment adviser to the Fund. Prior to Feb. 12, 2021, the Fund was managed by a different investment adviser. Before Feb. 1, 2022, the StepStone Group L.P. (“StepStone”) served as sub-advisor for the Fund. However, as of Feb. 1, 2022, StepStone is no longer the sub-advisor for the Fund.

A portion of the Fund’s assets may be allocated to Investment Interests which are not sponsored or advised by a Core Independent Manager.

1. Given the percentage of assets allocated to investment interests managed by KKR, Vista and Warburg Pincus the Fund is exposed to risks related to KKR, Vista and Warburg Pincus. Diversification does not ensure profit or protect against loss in a positive or declining market. There is no guarantee that any investment will achieve its objectives, generate profits or avoid losses. Past performance is no guarantee of future results and there can be no guarantee that any historical trends will continue over the life of the Fund. There can be no assurance that the Fund will be able to implement its investment strategy or achieve its investment objectives. Holdings are subject to change.