A differentiated hedge fund solution partnering with a select number of world-class managers.

Multi-Strategy

Global Macro

Quantitative Strategies

iDirect Multi-Strategy Fund (“iDHF” or the “Fund”) seeks to invest across multiple alternative strategies that are less correlated to traditional assets and aims to improve the overall risk/return profile of a portfolio.

Multi-Strategy 60-75%

- Balyasny Asset Management

- Millennium Management

- Point72 Asset Management

- Verition Fund Management

Quantitative Strategies 10-20%

- WorldQuant (SEALS)

- WorldQuant (GEAE)

Global Macro 10-20%

- Brevan Howard Asset Management

- Campbell & Company

Source: iCapital as of July 1, 2025. Anticipated allocation is for illustrative purposes only and is subject to change. Please see the iDHF’s Prospectus for additional details. The information contained herein is preliminary, is only a summary of key information, is not complete, and does not contain certain material information about the Fund, including important conflicts disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice. There can be no assurance that iDHF will be able to implement its investment strategy or achieve its investment objectives.

Strategic Focus with Complementary Strategies

Multi-Manager Approach

- Invests in a select number of experienced, difficult-to-access managers

- Seeks to deliver broad exposure across asset classes, geographies and sectors

Complementary Strategies

- Core allocation to Multi-Strategy managers with satellite allocations to Global Macro and Quantitative Strategies

- Focuses on strategies that are less-correlated to traditional assets and to each other

Emphasis on Risk-Adjusted Performance

- Seeks to generate consistent alpha across market cycles while minimizing drawdowns

For informational purposes only. The information contained herein is preliminary, is only a summary of key information, is not complete, and does not contain certain material information about the Fund, including important conflicts disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice. There can be no assurance that iDHF will be able to implement its investment strategy or achieve its investment objectives.

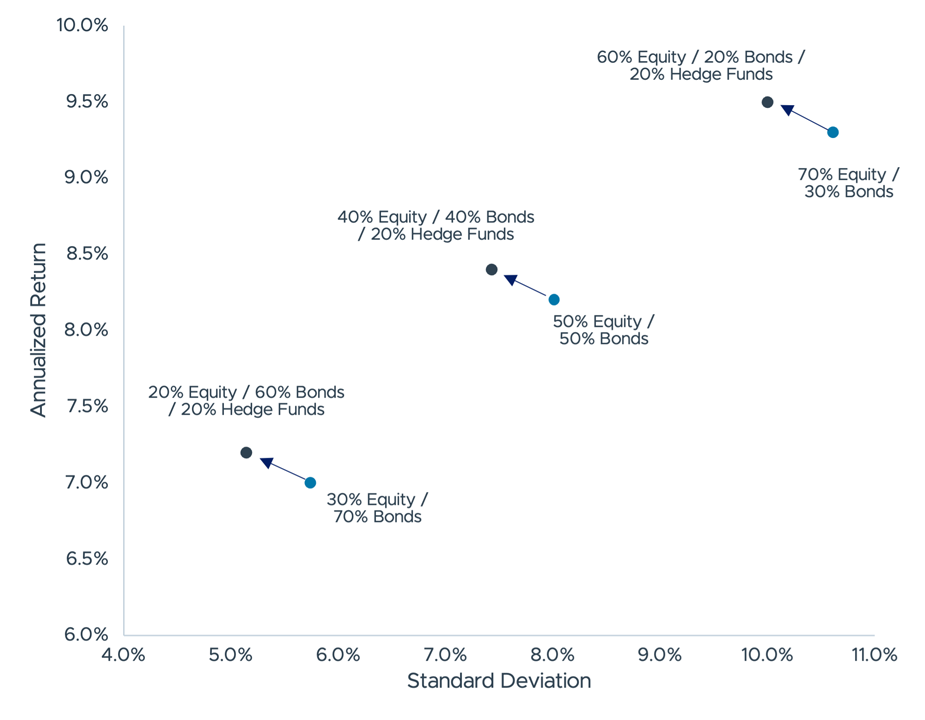

Diversification with Hedge Funds

An allocation to hedge funds can improve the overall risk/return profile of a portfolio.

- Globally diversified, multi-strategy funds provide broad exposure across asset classes, sectors, and geographies.

- These funds typically have an absolute return focus and low correlation to traditional markets, making them a potentially attractive complement to a client’s stock and bond investments.

- As a result, an allocation to hedge funds can improve the overall risk/return profile of a traditional balanced portfolio.

Source: eVestment. Data for the period January 1990 to June 2025. Hedge Funds refer to HFRI Fund Weighted Composite Index. Equity refers to S&P 500. Bonds refers to Bloomberg US Aggregate. Past performance is not indicative of future results. For illustrative purposes only. The information contained herein is preliminary, is only a summary of key information, is not complete, and does not contain certain material information about the Fund, including important conflicts disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice.

Non-traded investments are not valued as frequently as traded markets, which impacts volatility measures. Additionally, there are significant liquidity difference between public and private equities, as public equities can provide liquidity and greater access to company information and private equities have a longer time horizon and are considered illiquid.